Tech Firm ‘Grudgingly’ Sues British Airways For $450,000 After Airlines Refuses To Pay Its Taxes

- Sabre Corp, one of the world’s largest travel tech companies, has filed a lawsuit against British Airways, accusing the airline of refusing to reimburse nearly half a million dollars in taxes that fall under a decades-old commercial agreement.

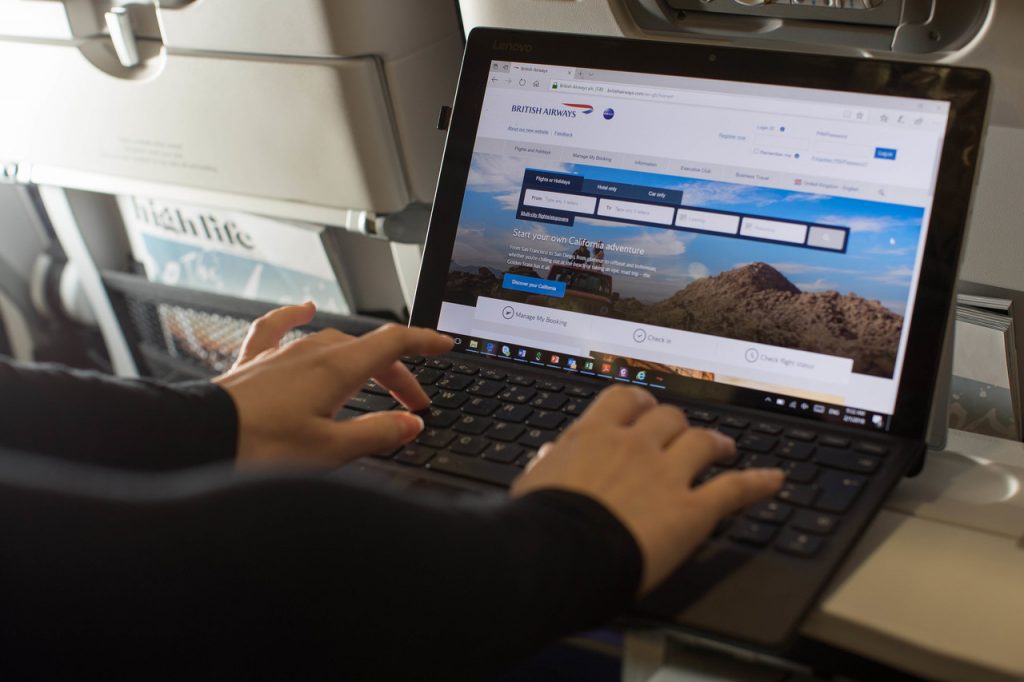

Anyone who has struggled to get British Airways to pay out compensation for a delayed or canceled flight will know it can be difficult to get the airline to accept its legal responsibilities. Now, one of the biggest travel firms in the world is facing its own uphill battle to get British Airways to pay what it says it is legally owed.

Earlier this month, Texas-based Sabre Corp filed a lawsuit in Dallas district court, accusing British Airways of refusing to pay nearly half a million dollars to reimburse the travel software company for costs it has incurred doing business with the airline.

Sabre is a major player in travel retailing, providing the software that more than 400 airlines around the world rely upon to make their flight inventory available to travel agents and online travel booking platforms.

British Airways has been using Sabre’s software for decades – their relationship extends back more than 35 years, and as recently as this year, the airline enabled a new system that allows it to market its inventory even more effectively, monetizing add-ons and ancillary revenue streams like never before.

It’s unusual for two business partners to fall out on such a spectacular scale, but Sabre says it has been forced to “grudingly” take legal action against British Airways after the airline refused to cover a $453,000 tax bill.

The dispute centers around a commercial agreement the two companies entered into back in 1991, when British Airways agreed that it would reimburse Sabre for any taxes it incurs as a result of doing business with BA.

Fast forward nearly two decades, and the British government introduced a new Digital Services Tax, which imposes a 2% tax on revenues of large tech firms that derive value from UK users of their software.

At first, Sabre was unclear as to whether the DST applied to the business it was doing with British Airways, but in 2022, tax authorities published a detailed manual for the DST, which included an example of a Global Distribution System in an online marketplace – this is exactly what Sabre provides to British Airways.

Sabre decided it had little choice but to register with His Majesty’s Revenue and Customs Service to pay DST, and the following tax yea,r it received a tax bill in the post for $453,863.

In turn, Sabre invoiced British Airways but the airline has allegedly refused to accept that the DST is, in fact, a tax.

After months of negotiations, Sabre says the dispute has come no closer to being resolved, so it has filed a lawsuit in a bid to get the court declare that the DST is, indeed, a tax that applies to the commercial agreement between it and British Airways.

It’s not just Sabre that has struggled to get British Airways to pay what it sees as legally owed money.

In a three months period late last year, independent arbitrators forced British Airways to pay out nearly £1.5 million (US $1.98 million) in compensation to passengers for delayed or canceled flights.

Between October and December 2024, an arbitration service that oversees compensation disputes adjudicated 2,833 complaints from frustrated passengers who had been denied compensation, and in 89% of those cases, the arbitrator ruled that British Airways must pay out compensation.

On average, passengers won £593 per award, bringing the total bill for British Airways to £1.48 million.

Sabre’s lawsuit against British Airways was filed in the Texas Northern District under case number: 4:25-cv-01142

Related

Mateusz Maszczynski honed his skills as an international flight attendant at the most prominent airline in the Middle East and has been flying ever since... most recently for a well known European airline. Matt is passionate about the aviation industry and has become an expert in passenger experience and human-centric stories. Always keeping an ear close to the ground, Matt's industry insights, analysis and news coverage is frequently relied upon by some of the biggest names in journalism.